5 Key Approaches To Calculated Risk Taking in the Distribution of Pharmaceuticals

Contents Overview

Today, political and economic changes are shaking up even the major world players. Not so long ago, the refugee crisis divided European countries, Brexit jeopardized the stability of European Union, and trade wars between some of the most powerful world forces, China and the USA, changed the economic flows between the East and the West. If this is the picture of only the developed world, where companies have been used to expect reasonable stability, we can assume challenges of businesses in the emerging markets are even greater. Combine this with the nature of the pharmaceutical industry, where intense bureaucracy involved in drug approval or execution of clinical trials are a part of every workday, and you can be certain – no matter the location, taking calculated risks is necessary. Not only because external changes, over which a distribution manager has no control, keep increasing in both frequency and magnitude but also because meanwhile the financial threats are rising.

As the pharmaceutical industry continues to face significant changes and challenges, the need for risk management in the industry has broadened and deepened. However, taking risks can sometimes prove to be intimidating, whether you’re going all-in during a friendly game of poker or quitting your long-time career to pursue one of your promising enterprise ventures. The truth is, as long as you understand the benefits and costs that would emerge from solving the problem at hand, taking risks can prove to be a valuable strategy in both personal and business life. Substantive risks that may come up whilst managing operations in the distribution of pharmaceutical products can be somewhat avoided. In the best-case scenario, with the use of five key risk management approaches described below, they could even be optimized to your advantage.

For any business owner, having the eagerness to take risks is an important attribute as risk defines entrepreneurialism

This is because a large factor that determines the success of a risky venture depends on the correct way of framing the initial problem at hand. Since not all risks are equal, a lack of proper framing all but guarantees that the focus will be placed on the right issue. Neglecting the fact that the way a problem is described plays a crucial role in conceptualizing different kinds of options considered to address the issue as well as the overall value of the desired solution, is where most risk-takers fail. Yet, for any business owner, having the eagerness to take risks is an important attribute as it defines entrepreneurialism. Devoting some time to making some careful decisions about risk management of the issues at hand will, therefore, lift your spirits and ensure maximum rewards.

The Widening Risk Scope for Pharmaceuticals

How Many Risks the Industry Faces Today?

The particularly tough clinical challenges faced by the big pharma in its continuous struggle with R&D operations, and by pharmaceutical distributors in their confrontations with specific requirements for market access, make the industry unique in multiple ways. Nonetheless, research illustrates that these characteristics, while unique and important for risk management, represent just a small fraction of the whole directive. We now live in a world where the lines that separate one sector from another are blurred.

Similar to energy companies, pharma distributors have high capital expenditure and long payoff periods for assets

Today, several other sectors have much more commonalities with the pharmaceutical sector, and as they face similar instabilities, the advanced risk management practices employed there can also be readily adapted to the pharmaceutical context. Similar to energy companies, pharma distributors have high capital expenditure and long payoff periods for assets. On another note, like banks, pharma distributors operate in a highly regulated environment, where compliance risks are very high and present across many global markets. Furthermore, pharma distributors aren’t exempt from cross-sector uncertainties, such as cyber threats, data breaches, supply-chain or quality risks, geopolitical exposures and liabilities from third or fourth parties, as any other company that operates nowadays. Consequently, it is not a secret that the pharmaceutical distribution players, big and small alike, undertake several risky ventures.

A result of technological advances, this is a growing concern for stakeholders involved in the industry, all of whom are now forced to face them in the interest of staying afloat, but also to rise over the competition as some of the exposure can actually affect the advancement over other pharma distributors in the market. This is especially crucial for small distributors with limited access to capital, as even one calculated risk-taking success can have a multiplier effect over time.

Challenges Worth Taking

What is Needed to Optimize Risks?

Every company will eventually be faced with risk management, either to take on a new promising opportunity or react to external changes. To make a successful contingency plan, certain elements have to be in place.

1. Presenting The Risks Before deciding to take on a new risky opportunity, it may be a good idea to present the elementary risks associated with the venture as a larger part of the whole decision-making equation. While it is rare that listing or discussing them will change your decision about the pursuit, more careful consideration will provide you with more complete information for making calculated steps in the process.

2. Ensuring Operational Capabilities Having a careful consideration goes hand in hand with the operational capabilities within the company. One common problem that leads to poor risk management is the lack of it. This can raise risks that range from delays in market entry to failure to comply with applicable regulations, to increased costs. Therefore, in order for a discussion about the pursuit of the opportunity to take place, as well as preparing a plan for mitigation of perceived challenges, it is important to find managers and executives with the appropriate skill sets and knowledge, along with a thorough comprehension of the unique demands of each one’s operating model, to run each division of the business effectively. 3. Having the Correct Knowledge Besides, knowing calculated risk management and not only the traditional one is vital because the practices differ greatly. To illustrate, business operations that work in current locations today won’t certainly work in new markets, and traditional approaches to managing risks might persuade you to avoid the new market. However, calculated risk management practices acknowledge that the opportunity might be worth taking due to the long-term potential of rewards and benefits.

It is especially important that smaller distribution companies are aware of this since they are usually the ones lacking the above-mentioned resources. Big pharma can usually find it within the company even after the managing of the issues already spontaneously begun, but smaller players will have to plan as taking on risks might require outside help and, thus, can increase the current expenses. Additionally, the risks get even more complex to manage, when pharmaceuticals are involved. As in other sectors, medical distributorship companies can contract with vendors and outsource manufacturing from other locations. However, when importing or exporting medicine, certain regulations need to be followed. The basic risk that arises here is that the outsourced help may not adhere to the same, equal or higher quality and safety standards, both in respect to the manufacturing process and material sourcing of active pharmaceutical ingredients, like those found in your market.

This is why at AdvaCare, we have implemented a unique business model centered on creating a collaborative relationship that guarantees a win-win outcome for all parties involved. This, together with our company’s commitment to guarding against intentional or inadvertent irregularities in product quality, all but ensures a lucrative and long-term commitment to both AdvaCares’ and our distributors’ success.

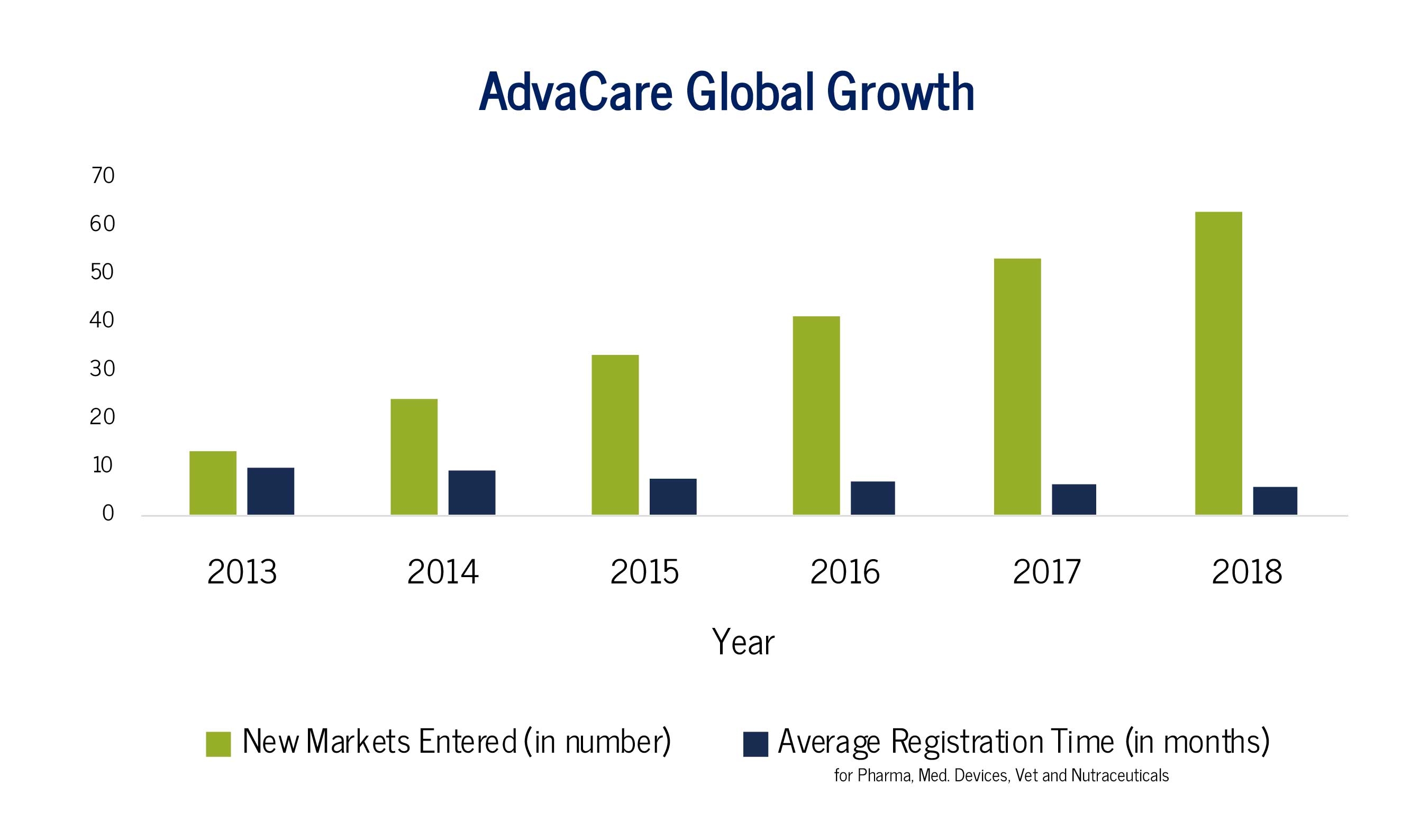

As a result, the number of new markets AdvaCare has entered has steadily grown in a relatively short period. Due to the experiences gained, including increased control of the supply chain, better product adaptation to markets and improved support for our distributors, we have experienced rapid growth in Africa, Southeast Asia, and Middle East regions. Likewise, we have also been able to substantially reduce the average time needed for successful registrations by better document preparations, improved understanding of regulatory compliance in growth regions and upgrading of our production lines.

Transforming Risk Management

How To Take Calculated Risks Correctly?

For every business it is prudent to analyze the advantages and disadvantages before risk-taking. It is common knowledge that undertaking in unrewarded risks delivers little or no upside value. In direct contrast, rewarded risks must be taken to drive company value, for example through investment in innovation that can drive new value. Indeed, if the advantages are sufficient, then diving into the opportunity seems justifiable, especially if it also means the possibility of boosting profits for your business. In a nutshell, risk management is an integral part of proactively managing your company’s strategy and operations and it recognizes that risk and value cannot be separated, which implies that calculated risk-taking is necessary for your pharmaceutical distributorship to survive and thrive. In fulfilling this ambitious task as an owner you need to ask yourself the following questions:

- How closely linked are the plans, strategies, and activities of your operations with your risk management approach?

- How prepared are you and your management team to seize the right opportunities and mitigate risks, in order to capitalize on the cross- and up-selling opportunities?

With these two basic questions in mind, you can then use the following key approaches and take calculated risks:

1. Implement a strong quantitative view of risks that are more important. For calculated risk management to be effective, there needs to be a strong initial process of identifying, quantifying and inventorying of risks – both familiar and new. In this regard, companies in pharma could emulate the clear processes of identifying emerging financial and non-financial risks established by financial institutions. Consider following the process established by banks:

- Design an inventory of risks and compare them against a standardized risk allotment.

- Estimate the likelihood and severity of each risk and consider potential correlations among them.

- Combine the risks and rank them in order of priority.

- Manage the risks by associating them with regular business processes, such as strategic and financial planning, enterprise risk management, and controls.

Once the above steps are regularly implemented, the approach will become ingrained to your business operating model. It is important to note that the risk inventory should neither be very detailed nor so complicated that it cannot be acted upon.

2. Establish your risk appetite and prioritize where to focus. A strong risk analysis scheme enables a company to make better-informed risk decisions as well as appropriately allocate resources for effective risk monitoring and mitigation.

If you can successfully keep the problem simple, then the odds of success in solving it increase adequately

As a business owner, when trying to describe risks, it may be a good strategy to try to keep it as simple as possible. An excellent way of doing this is through concision. When faced with a problem that is difficult to define quickly, try to state in 40 words, then cut it down to 20, then to 10 and ultimately till you are left with a 5-word problem. An important rule of thumb of calculated risk management states that “if you can successfully keep the problem simple, then the odds of success in solving it increase adequately”. Such a simple yet effective process helps to create a fact base to underpin strategic decision making on topics such as capital allocation, mergers, acquisitions, investment, and divestment.

3. Take advantage of the ‘SCAMPER’ rule. It can often be difficult to come up with new ideas when you’re trying to solve a particular problem or address a particular risk. This is where creative brainstorming techniques like SCAMPER can help.

The term ‘Scamper’ is a mnemonic that stands for Substitute - Combine - Adapt - Modify - Put to another use - Eliminate - Reverse. It provides you a complete checklist that will help you to think creatively when attempting to address any problem-solving process. You use the tool by asking questions about existing problems you’re facing, using each of the seven prompts above. These questions may help you come up with more creative ways of solving the problems at hand. The tool induces a level of strategic planning that is crucial in risk management as it may affect the responses of the organization’s leadership, how investigation and governance will be conducted, how marketing, brand, and communication teams can help with risk management, and what financial and liquidity provisions are in place to ensure minimal risk exposure to unnecessary risks.

4. Organize multiple layers of defense to strengthen risk surveillance. Try to consider organizing roles, responsibilities, oversight, and governance along three lines of defense – famously known as the 3LOD model. It is a proven mechanism in calculated risk management where the ‘first line’ comprises the frontline teams that engage in activities that might create risk. The second line provides independent oversight and challenges while directly reporting to management. It also sets policies and standards, ensures the company’s risk profile does not exceed its risk appetite and oversees the general effectiveness of control. Meanwhile, the ‘third’ and final ‘line’ usually has the corporate audit function to ensure the overall effectiveness of the ‘first’ and ‘second’ lines of defense in risk management.

5. Develop a compelling crisis-management strategy. It may be prudent to note that no matter how strong your business’s risk-management capabilities are, you can never rule out the possibility of a crisis circumstance. Research has illustrated that such events have at least doubled over the past decade across multiple industries, with the pharmaceutical industry being no exception. This implies that as the threat level keeps increasing, so does the need to not only improve core risk-management capabilities but also maintain a strong level of crisis preparedness.

A Vast Universe of Potential Techniques

Why Is the Consistency Crucial?

In conclusion, as an owner of the pharmaceutical distribution business, you need to thoughtfully plan and update your crisis management approaches by identifying risk scenarios and developing playbooks to manage each individually. Upgrading your business’s risk management capabilities could potentially allow your company to cope well with today’s rising regulatory complexity, new delivery methods, and data-driven innovation in the pharmaceutical industry.

As the pharmaceutical industry evolves and changes, so too will the nature of the risks faced by companies in pharma

Still, as the pharmaceutical industry evolves and changes, so too will the nature of the risks faced by companies in pharma. Although the calculated risk approaches discussed should be on every pharmaceutical business owners’ minds, they represent only a small sample of the vast universe of potential risk management techniques. Thus, consistent learning and approach shifting is crucial.

Learn more about calculating risks and problem framing in “Pursuing Risk Intelligence in a rapidly changing industry: Addressing operational risks faced by pharmaceutical companies”, a report from Deloitte, “Pharma Industry Overview” by InvestmentBank.com, “How to Frame a Problem to Find the Right Solution” article by Forbes, and “Pharmaceutical Risks Overview” by KPMG.

Don't want to miss the next AdvaCare article?

Recommended Content

How to Profit From the Booming Market of Disease Prevention?

The Pharmaceutical Industry: Key Market Movements You Must Know About Before 2023

5 Ways to Overcome the Challenges of Pharma Distributors in Developing Countries