5 Ways to Overcome the Challenges of Pharma Distributors in Developing Countries

Contents Overview

The current pharmaceutical and healthcare products distribution model in developing countries is exhausted and requires a new way of thinking by the distributor. Innovation in thought, adaptation, and even possibly disruption, will be required to survive the oncoming paradigm shift.

Despite alluring potential, most large pharmaceutical firms have not been able to maintain a stable position in emerging markets – developing countries account for only 10-20% of the overall revenue of multinationals. Enter China and India. Competition has brought low cost generic drugs and medical products to the masses, and along with it much growth in both the manufacturing and distribution sectors, especially for SMEs (Small to Medium-sized Enterprises). But for local distributors in developing markets, substantial challenges are looming as population growth cannot keep pace with the flood of products and competitors entering their markets. The weak players that are not able to adapt to this new reality and changing landscape will fade away and die.

Distributors in emerging markets throughout Africa, Asia, the Middle East, South America and East Europe need an effective, multifaceted strategy to sustain competitiveness and drive profits. We, at AdvaCare, have analyzed the value and supply chain to identify the main challenges that could lead distributors to start thinking about how to take the necessary steps now to be ahead of the curve and create competitive advantages. Keep in mind that in every challenge, there is also an opportunity – the key is to spot where and how to exploit what others are not doing.

Challenge #1

Premature Distribution and Logistics Networks

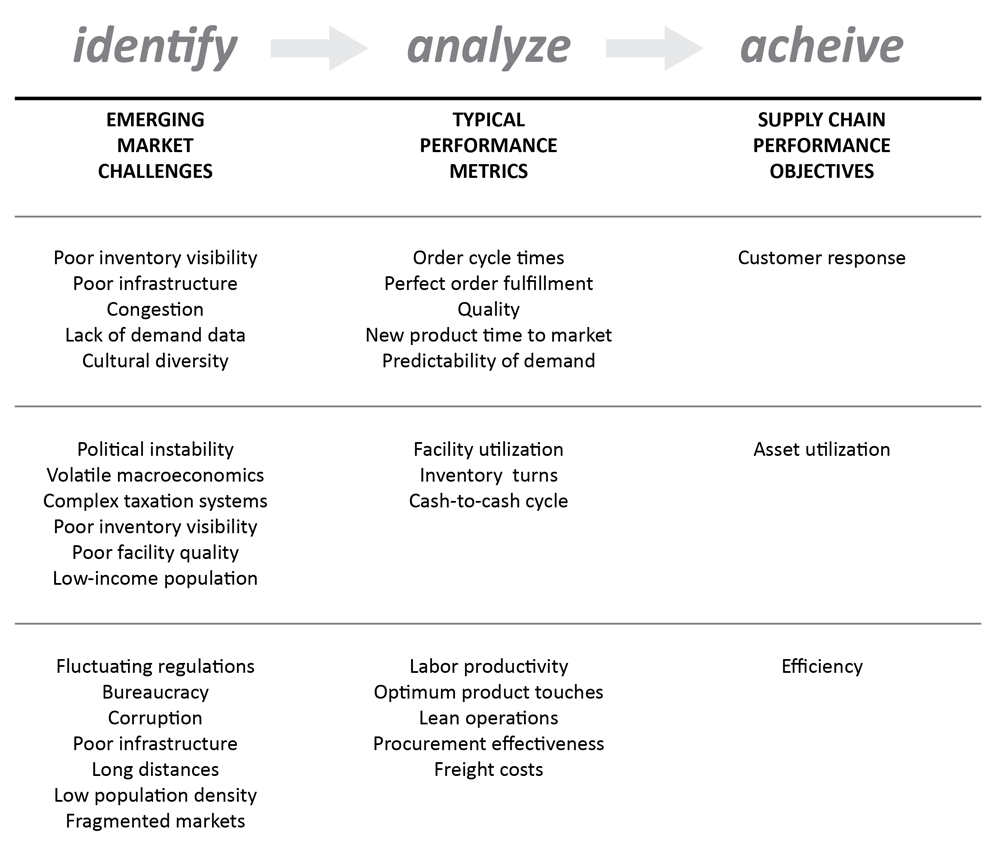

Firstly, it is important to understand the difference between a supply chain and a value chain. A supply chain is the process/stages of all parties involved ending with the fulfillment of a customer request, while a value chain is a set of interrelated activities a company uses to create a competitive advantage. While both the supply chain and value chain in emerging markets are often undeveloped, inflexible and fragmented, distributors have no choice but to work with such constraints.

Take a systematic approach to maximizing your supply chain:

Takeaway:

Depending on the options available to the distributor within the supply chain, look for the weaknesses and make incremental improvements. In the value chain, look at what other distributors are not doing, or not doing well, and differentiate that part of the value chain to improve on an existing competitive advantage or create a new competitive advantage. For example, while you cannot improve the roads in your country, you can consider a new mode of delivery for your customers that are more flexible or tailored to their needs.

Some other considerations:

- Supply Chain Evolution: It is also important to “future proof” your local supply chain by remaining flexible; it is likely the supply chain in your country is evolving, so be sure to evolve together with it.

- Role of Technology: Embrace the role of technology in your value chain. While there will be technological restrictions in most developing countries, consider how to invest in new software and hardware that can bring efficiencies.

- Local Competition: Carefully analyze how your competitors structure their supply chain and value chain. Evaluate what you can do differently.

- Brand Protection: Make sure to protect the brands you are distributing by product differentiation through distribution channels, higher customer expectations and value added services.

Challenge #2

Complex Regulatory Environments

Any successful domestic distributor of pharmaceuticals or medical devices is well aware of the challenges of the regulatory framework in their country. While most emerging markets have unregulated or under-regulated aspects of their pharmaceutical sector, compliance is rapidly improving as governments are attempting to better control the importation and distribution of such products that are essential for the health of their citizens. The product registration process could take years, stuck in the system, which can make financial and distribution planning very difficult.

Takeaway:

Smart distributors will have a clear distribution plan for when and how to launch their products. Even well-established distributors, that could have a hundred or more registered products in distribution, still need to be consistently adding new products to their range. Such new products should be carefully planned, specifically accounting for how to best work within the regulatory framework in their country and the lead time from starting the registration process up to the point of completion and market entry. For example, if 10 new products are planned for registration, consider including or adding such products as OTC drugs, medical devices or healthcare products that can be launched faster while waiting for the registration of more regulated pharmaceuticals to complete the process. In this way, you can have a phased approach and realize a faster ROI (Return On Investment).

… consider not only product differentiation, such as different packaging, presentation or pack size, but also how to better engage your customers with incentives, product displays or a value-added service.

Challenge #3

Uncertain Pricing and Product Supplies

Price vs. Quality is always a balancing act for the distributor. While developed markets have a more segmented product range, meaning there is demand for all price points of a product, distributors in developing markets have less options. Given the lower spendable income of the average consumer in developing countries, the most important consideration for a distributor is the best value for the minimally accepted quality standard of a product. Case and point: your market might not have demand for a fancy, expensive clinical thermometer with every bell and whistle, but even a basic thermometer at the right price point must still function properly and meet the expectations of your customer and the consumer.

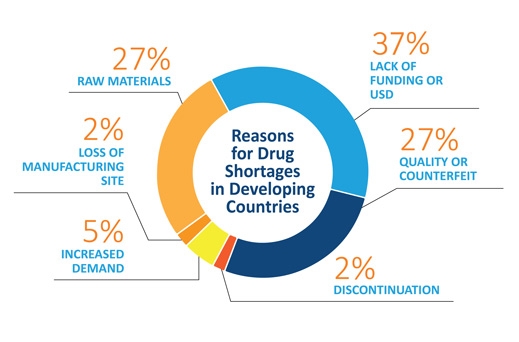

Given the long lead time for payment, production, shipping and customs procedures of pharmaceutical products, shortages of specific drugs in a distributor’s country are a common occurrence. The distributors that have stock of such products will, usually unknowingly and unexpectedly, reap big profits if they are the only game in town.

Takeaway:

While the dynamic of developing markets is such that distributors must focus on low cost, acceptable quality pharmaceutical and medical products, the trend in most markets is that quality standards are evolving – the distributor must evolve as well. As the average consumer’s income rises, so does their spending power and their willingness to spend more money on critical products such as those for healthcare. However, this trend is slow and takes years. One way the most successful distributors cope is by differentiating their products while still staying within the range of acceptable price points. Often such differentiation does not require higher costs, but rather creativity. For example, consider not only product differentiation, such as different packaging, presentation or pack size, but also how to better engage your customers with incentives, product displays or a value-added service.

While reaping unexpected profits is not necessarily a bad thing, to some degree it also reflects lack of proper planning. Some market forces and circumstances will be impossible to predict, but perhaps not impossible to properly prepare for. Many pharmaceutical and medical distributors in developing countries build their business model around filling shortages in the market, relying on timing based on inside information and assumptions. However, this is not a sustainable business model. Instead, successful distributors stock a range of products consistently, despite the lower margins of many of the products, because such distributors realize that their customers value consistency in supply.

Challenge #4

Shortage of Skilled Talent

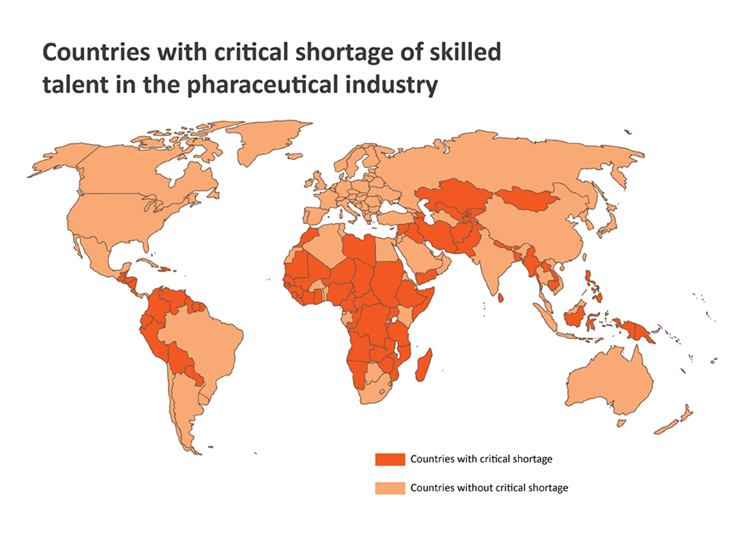

It wasn’t long ago that emerging economies depended solely on a cheap, labor-intensive work force. But this dynamic is changing as more skilled talent is in demand to enable such economies to move up the value chain. In the pharmaceutical and healthcare sectors of developing markets, every distributor is well aware of the lack of qualified and capable pharmacists, regulatory experts and competent managers and salespeople. Depending on the region, skills shortages in the pharmaceutical and healthcare sectors throughout Southeast Asia, South Asia, Africa, the Middle East and South America range impact and prevent between 45% and 71% of employers from hiring the necessary skills they require.

Takeaway:

As with supply chains and value chains, where there is a challenge there is also an opportunity. The shortage of human capital in emerging markets is a systemic challenge that will not be solved overnight as education and infrastructure takes decades to improve. For larger companies, the problem can be mitigated by paying high salaries and bringing in foreign skilled talent from other countries. However, these same options don’t usually exist for smaller distributors.

… human resources should consume 20-35% of the gross profit of a distribution business.

Depending on the country, product mix and other factors, human resources should consume 20-35% of the gross profit of a distribution business. For highly technical positions, such as pharmacists or regulatory/compliance experts, even small distributors should consider additional budgeting to include such staff who can enable untapped profits by speeding registrations of new products, providing valuable insight for up-and-coming products, etc. It is more difficult to attract and retain such sought-after employees when a higher education is required and the pool of such talent is limited. However, for less technical employees, the distributor has more control to shape and control the outcome. Much needed competent managers and salespeople can be trained, and doing so can provide a serious competitive advantage. Distributors should conduct regular workshops and trainings that not only serve the company, but also allow each individual employee to realize the value of working in a firm that improves their capabilities and perceived self-worth.

Challenge #5

Lack of Financial Resources

It is no secret that shortages of capital, access to USD and lack of banking resources and legal recourse are major barriers for financing the distribution of pharmaceuticals and medical products in the developing world. The negative impacts of these insufficiencies vary greatly by region – Africa has the least access to such financial tools while Southeast Asia and the Middle East have greater access. Distribution of pharmaceuticals and medical products can be a capital intensive business which is further complicated given that most of the products have a shelf life, are perishable and require specific storage conditions. Therefore, barriers to entry can be high and allocation of scares capital causes frequent interruptions in stocked product.

Takeaway:

Overcoming the lack of capital in capital-intensive businesses such as pharmaceutical distribution requires careful planning and creative solutions. To ensure consistent stock of products, consider a higher frequency of smaller orders from manufacturers even if the cost of goods and importation costs are higher – simply do a cost comparison to see your increased costs and measure this against the importance of ensuring your customers to not go to other suppliers when you are out of stock. Comparing the cost of customer acquisition vs. cost of customer retention should prove that the only way to scale a distribution business is to retain customers while acquiring new customers simultaneously.

Also, common mistakes should be avoided. Overextending credit terms to customers, especially just one or a few customers, is a common mistake of distributors that can jeopardize financial solvency. Providing credit terms are part of the distribution game, but mismanaging finances is not. It is important to only extend credit to the point that your distribution can continue the normal course of business if the funds owed go unpaid. One possible way to mitigate risk and improve cashflow might be to provide incentives to customers that purchase goods upfront. It is highly recommended that taxation and financial professionals be consulted as the cost of such services is well worth the future savings and avoidance of unnecessary risk.

Don't want to miss the next AdvaCare article?

Recommended Content

Pet Supplements Manufacturer: Functional and Premium Ingredients with USA Quality Standards & Traceability

Global Pet Supplement Market Trends: Why Distributors are Shifting to Premium Grade Quality

TickZero™: High-Margin, 12-Week Flea & Tick Protection, Distributor Opportunity in LMICs