The Pharmaceutical Industry: Key Market Movements You Must Know About Before 2023

Contents Overview

The pharmaceutical industry is constantly evolving. Like any other industry, it is no stranger to changes. In recent years, such changes are even more predominant due to shifts in societal demographics and advances in technology. Especially in emerging markets, significant developments can be observed as pharmaceutical trade is in the pivotal stage of growth towards maturity. Aside from the geopolitical perspective, it is important to realize transformation is happening across all stages of the pharmaceutical supply chain, from R&D and manufacturing to the approaches towards end-consumers.

There are steps you can follow, at any given time, for efficient optimization of your supply chain. Yet, the end of the year is a great opportunity to make an overview of key market movements you should take into account when planning for the one ahead. However, no KPIs, optimization plans nor procurement planning will be as beneficial as they can be if you do not consider shifts in the market which have the rising power to change core dynamics completely.

Is 2023 THE YEAR for pharmaceutical distributors in emerging markets?

This report will make your strategy planning easier, as it offers an overview of key market movements that have left a mark on the industry in recent years, but will continue affecting in the years to come. Use them as your starting point before writing down your 2023 optimization strategy. Finally, to make your planning even more efficient don’t forget to check out our previous article about efficient optimization in pharma supply chain here.

Change in Disease Focus

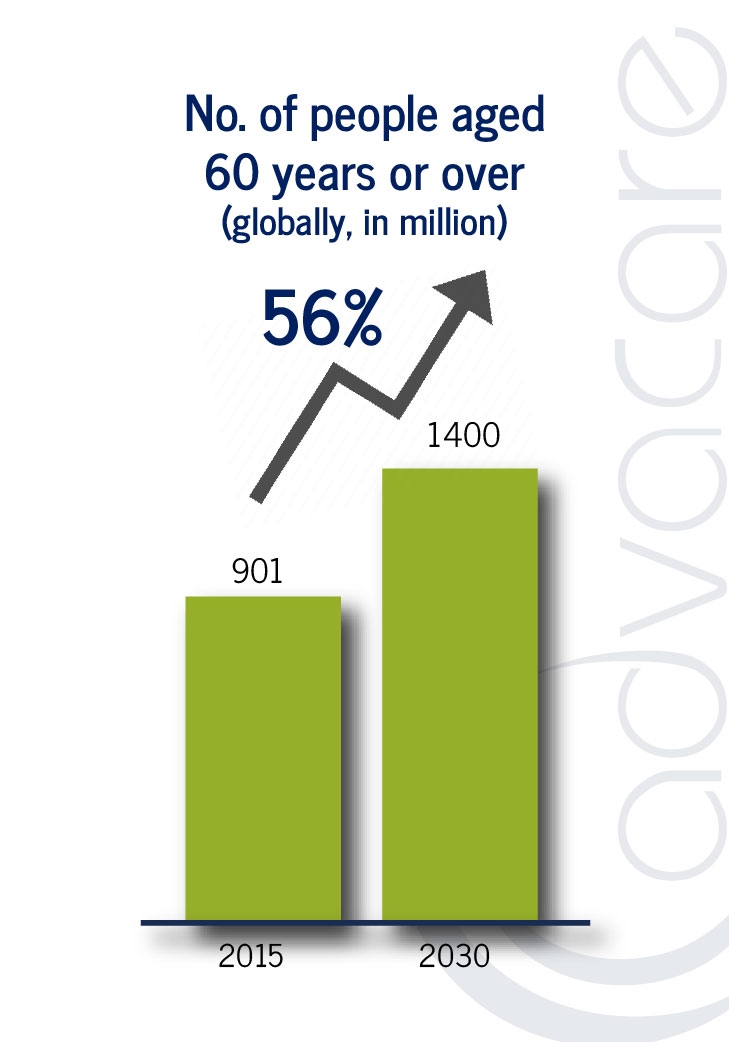

Epidemiology is Shifting Due to Aging Population

The number of people in the world aged 60 years or over is projected to grow by 56 per cent, from 901 million to 1.4 billion. In the developing region especially, the growth of population over 60 years old will be higher than the global average between 2015-2030. Moreover, in Latin America and the Caribbean, the number of people over 60 years and older will increase by 71%, the highest out of emerging markets. Second, comes Asia with 66% and Africa with 64% growth. By comparison, globally we will only witness a 56% increase in the population of the elderly.

Besides the increase in the number of population, modern society is also faced with an increasingly aging population across all geographies. Predictably, pharmaceutical industry catering long term treatment and health care will grow due to an increase in demand. This issue is one that has been anticipated in the developed world, but now emerging markets are catching up. Populations in developing countries are aging at three times the speed of populations in developed countries. While the peak of the changes is expected only in 2050, the pharmaceutical industry is already shifting to adapt to these changes.

How will this affect the industry? For starters, health spending will likely increase. According to the US Panel Survey done on medical expenditure, it can be predicted that global health spending will increase with the boom in population aging. Additionally, health systems are expected to prepare in addressing specific health concerns for older persons, such as specific conditions (back and neck pain, injuries due to falls, hearing loss, etc.) and diseases (Alzheimer’s, dementia, diabetes Mellitus, osteoarthritis, etc.).

Takeaway #1 Health spending increases from the age of 55. In 2023 refurbish the list of products you are distributing, to make sure you are covering all the rising conditions and diseases of the aging population, both with enough stock supply as well as appropriate product availability.

Change in Economy Focus

The Rising Importance of Distributors in Emerging Markets is Happening

Representing over 95% of total sales in the pharmaceutical market, distributors are the main driving force of the industry. As the emerging markets show an unprecedented increase of demands in recent years, the big pharmaceutical corporations have been jumping in for the first foothold of the market.

Yet, recent years show that the approach of major pharmaceutical companies to the emerging markets was considered a mistake to be learned from. According to one of the top pharmaceutical executives, “Our biggest mistake was to treat emerging markets like mature markets. We were wrong. Pharmaceutical strategies have to fit a country’s individual needs and development.” Healthcare distribution, as defined by the Healthcare Distribution Alliance (HDA), has never been just about delivery. It is about getting the right medicines to the right patients at the right time, safely and efficiently.

Local and regional distributors have an upper hand in working with their markets. With critical market insights for decision making, they are able to handle the processes more efficiently.

Healthcare distribution is about getting the right medicines to the right patients at the right time, safely and efficiently

However, studies have shown that the gap between availability and access for the specific market demands in different regions are still quite wide. Demand for reliable and qualified distributors is increasing. Key benefits of implementing a distributor collaboration solution have been seen in:

- SALES GROWTH

- OPTIMIZED COSTS

- REDUCED NON-PRODUCTIVE INVENTORY

- BETTER DATA

Most importance should be put on the last points, as timeliness of drug delivery in times of need has been one of the areas most lacking efficient results, and it can also affect life and death situations most directly.

Takeaway #2 With the correct approach and enough investment, your business can grow significantly. In 2023 focus on business development by ensuring you have enough market knowledge and can respond to market demands quickly. For tips check out our previous article about sources of valuable information and tips on how to be more agile as a local distributor here.

Change of Most Important Segments

Veterinary Medicine is the Driving Force of Growth

Major focus on the emerging market lies beyond different therapeutics of pharmaceuticals. Up to the mid-2023 in particular, enormous market growth is expected in the veterinary healthcare industry. Regions in emerging markets such as Latin America, Asia Pacific, Middle East, and Africa are expected to grow even more demand than the global average.

Therefore, major shifts in the veterinary healthcare distribution can be expected there, as new and existing distributors emerge to meet market demand.

Takeaway #3 By choosing the correct product segments for expansion, you can become even more successful. In 2023 focus on veterinary products as the demand for animal healthcare products is expected to grow significantly. Reasons why this is happening are plenty. Learn about them in detail in our previous article here.

Change in Disease Patterns

Non Infectious Illnesses are Rising Disproportionately Fast

In many areas of the developing world, infectious diseases still dominate. Diseases like malaria, tuberculosis, and HIV/AIDS can still cause rapid deaths even with available medications for prevention and treatment. Despite this, as clinical advances make treatments more available and efficient, many of once acute deadly diseases are slowly evolving into manageable chronic or treatable conditions.

However, the specter of health issues in the developing world is starting to look much more similar to those in the West as diseases once associated almost exclusively with the developed world are now emerging there due to changed habits, living environments and social patterns. The trend is also connected with the growth of wealth in emerging markets, bringing the number of “lifestyle disease” cases at the all-time high. Therefore conditions like diabetes, cardiovascular illnesses and problems associated with smoking, alcohol or drug abuse, are not any more frequent only in the populations of the developed world.

As a study from PwC suggests, diabetics number is expected to rise for 20% in the next 5 years in emerging populations. Other examples are oncological diseases and cardiovascular diseases, both with the same growth prediction of 20%.

Takeaway #4 While drugs for infections such as antimalarials, or test kits for tuberculosis and HIV should still be in your offer, in 2023 you should focus on a wider specter of remedies for cardiovascular conditions as on the pharmaceutical side, the demand for those treatments will likely be steadily increasing.

Change in Health Awareness

Information Availability is Affecting Lifestyle Choices

Advancing technology, wealth growth and ease of convenience in the emerging market might be the leading cause of lifestyle illnesses. But with it, global awareness on the importance of fitness and health is also at an all-time high. In the developing world alone, over 2 billion people have internet accessibility. With an abundance of user-friendly information available, understanding of better lifestyle choices and nutrition disease prevention is also on the rise.

This trend can be seen particularly in nutraceutical segment of the industry. Within seven years, from 2018 to 2025, the market is expected to more than double and grow over 124%. Since the shift from treatment to prevention in healthcare is happening, and consumers have more attention to dietary supplementation than ever, a rising amount of nutraceuticals distribution can also be seen. In particular, essential supplements like extracts, amino acids or fatty acids, such as omega-3 fish oil are the most popular.

Moreover, health conscious individuals are utilizing more than just supplements to ensure their optimal health and condition. Consultations through web applications are emerging, with consumers becoming more aware of the importance of understanding their body health and symptoms. Advances in technology also make it easier for individuals to track their health and improvements via wearables, such as Fitbit. Better understanding of health and nutrition importance also increases the willingness to use wearables for tracking health (heart rate, glucose, etc) or aid (hearing). While most diagnosis for various diseases are better left for medical professionals, data tracking with technology definitely helps in more accurate diagnosis during the visit. This is why the trend is definitely not going anywhere soon.

Takeaway #5 Think about ROI that preventive healthcare products could bring to your market. In 2023 remember to target city areas, such as the capital and other mega-cities, which are rapidly emerging right in the developing markets. Offer your urban clients, such as retailers or pharmacies, products ranges for preventive health like AdvaLife.

Change in Consumer Preferences

Secondary Brands are Becoming the Best Alternative

Different needs in various regions of the developing market have driven innovation in the production and marketing of pharmaceutical products. Once, the only two available options in the developing markets were either premium global brand products or unbranded cheap generic products with no quality guarantee. Now, secondary brands and branding is seen as the best alternative for much of the emerging market consumers.

Most buyers are inclined to make a direct correlation between the packaging and product quality

Simply put, with more access to various brands of healthcare options, consumers in emerging markets can now not only look but also find appealing and high-quality products that are still affordable. In OTCs in particular, well-designed packaging is also available and can advertise the brand better as well as sell more products. Moreover, packaging must also be clear and concise in giving information regarding the benefits and proper usage of the product. All of this is important because most buyers are inclined to make a direct correlation between the quality of the packaging and the quantity of the product.

Takeaway #6 Manufacturers play a key role in its own product branding, but with many available affordable options, distributors alike must have a keen idea on which products will be attractive to their target markets. In 2023, make sure to put emphasis on marketing and branding and think about the promotion of your products, in particular OTCs where end-consumer plays a key role in the buying process. For easier market entry, think about partnerships with companies such as AdvaCare, which offer an extensive marketing support to distributors like you.

Change in Distribution Channels

Emerging Markets are Growing Towards Maturity

The year 2023 welcomes a massive opportunity from the emerging markets. Countries with previously lowest usage, will see the largest increase in alignment with development gains. According to IMS Institute’s Health Market Prognosis, regions like Asia-Pacific, Middle Eastern & Africa will see the highest increase in pharmaceuticals consumption by Standard Units of Doses (SU). For example, in Africa and Middle-East, the number of standard units used will increase from 300 to 500 billion, according to the same study. Therefore, increasing their consumption only for around 20%. Different can be said for the Asia-Pacific region, in which the consumption of medicine will rise substantially. The increase will be driven by China and India, as well as Indonesia, with the latter increasing the SU number per person per day to 3.26 SU.

On the other side, Europe will only have a minor increase from SU doses rising from 818 billion to 916 billion, mostly driven by eastern Europe, for example, Poland. As the world’s population tops 7.6 billion in 2023, per ca-pita usage of medicine will reach about 1.6 SUs per person per day.

For the distribution business, it is important to know about the SUs data by region. While the emerging markets only account for 36% of global pharmaceutical market revenue, they have a disproportionately large share of global pharmaceutical distribution market revenue, coming all the way up to 64%.

This being said, the supply chain in the emerging markets is an important one. Not only to make drugs available to those in the most need, but also because it is comprised of a complex network of importers, wholesalers, distributors, and retailers. And as the developing markets are in the peak of growth in terms of pharmaceutical sales, a partnership among all of the trusted suppliers and knowledgeable distributors will be one of the key driving forces to the industry maturity.

One thing that must be improved in order to reach that, is the visibility of what consumers actually purchase and when they do it, countering occurrences of stock-outs or overstocking. With improved availability and speed of global distribution to the many regions of the developed markets, the process is now, fortunately, one step easier to achieve in the developing world as well.

Takeaway #7 Due to technology advancements, as an importer you now have the ease of accepting goods at desired destinations. This gives you more time and the ability to focus on market reach. In 2023 put it in the center of importance, not only for the growth of your business but also for making essential healthcare products available and affordable to many more people worldwide.

Learn more about key market movements of the pharmaceutical industry in our sources for the article and report: “Global Medicines Use in 2020” report by IMS Institute for Healthcare Informatics; “Why is Packaging Design Artwork Key in Pharmaceutical Marketing?” article by Dan Keller in Marketing Insights; “Branding: When One is Not Enough” research by Ram Subramanian and Dr. Rehan Baqri; “How do health expenditures vary across the population?” research by Bradley Sawyer and Gary Claxton; “The Influence of Emerging Markets on the Pharmaceutical Industry” research by Maya Tannoury and Zouhair Attieh; “World Population Aging” report by the United Nations; “Population ageing in developing countries: burden or opportunity?” report by IPPF; and “Emerging markets, distribution imperatives and strategies” report by TradeEdge.

Don't want to miss the next AdvaCare article?

Recommended Content

Pet Supplements Manufacturer: Functional and Premium Ingredients with USA Quality Standards & Traceability

Global Pet Supplement Market Trends: Why Distributors are Shifting to Premium Grade Quality

TickZero™: High-Margin, 12-Week Flea & Tick Protection, Distributor Opportunity in LMICs