Pharma & Medical Distribution Continue to Thrive in Emerging Markets — Learn How You Can Benefit

Contents Overview

It is no secret that 1 out of 3 people worldwide have problems accessing essential medicines. This accounts for up to 2 billion individuals who are dying each year from preventable or treatable diseases, mostly in low and middle-income countries, Access to Medicine Foundation reports. According to the International Monetary Fund, the number is even higher, with 85% of the world’s population having limited options for safe and effective drug products, accounting for 6 billion people. Economic challenges are the obvious reason for this. What are the other challenges and how can a small local medical distributor benefit from it?

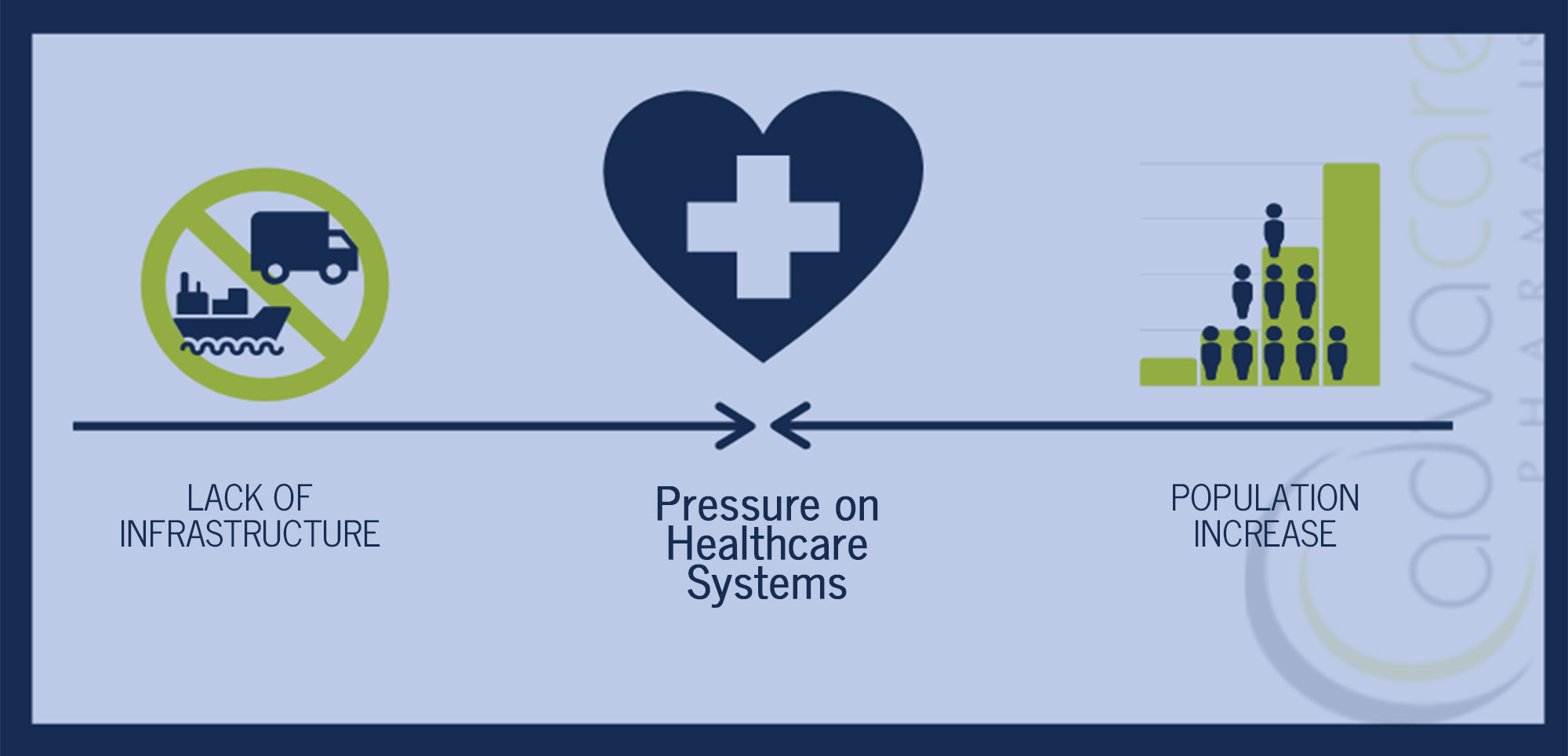

On one end of the challenge spectrum, lack of transportation and supply chain infrastructure is at fault for inadequate access to remote areas. On the other side of the spectrum, there is the inevitable quickening pace of urbanization and increasing overall population of the world’s poorest countries, compounded by the reality that the adoption of a western lifestyle creates additional healthcare needs. Across the entire spectrum, there is an unsustainable downward pressure on the established healthcare systems of countries in the developing world.

With the addition of increasingly affluent middle classes and longevity, social and physical environments are changing greatly. The overall health of populations reflects all of this. Did you know that the majority of the world’s top 30 megacities are in the emerging markets? Consequently, not only the populations of cities are on the rise, but also non-communicable diseases as well. Conditions that used to only be the problem of high-income countries are putting the health of more and more developing nations at risk. Access to Medicine Foundation, for example, included cancer on their 2018 Access to Medicine Index analysis for low- to middle-income countries for the first time. The results have shown that more than half of global deaths caused by cancer now occur in developing countries.

Did you know that the majority of the world’s 30 megacities are in the emerging markets?

In addition, diseases such as cardiovascular illnesses and diabetes have also been observed to follow similar patterns in the emerging markets as in the West. Diabetes, for example, is expected to grow by 20% or more by 2030. All of this reflects in not only unmet medicine demand but also in the deficiency of trained medical personnel, fragmented hospital infrastructure and lack of affordable healthcare.

The Need For Diversity

Why can a small medical distributor compete with big pharma?

Fortunately, it is not all bad news for healthcare standards in the developing world. In the fight towards the improvement of global health, a lot has been made already. In recent years, big pharma has finally taken notice of growth opportunities in emerging markets and have started to take action. As a result, for example, it has been a factor in the reduction of child mortality by almost 50%, and more than half of all people living with HIV/AIDS are now able to access antiretroviral therapy. Still, in order to “close the gaps that remain, a greater diversity of companies must get involved and stay engaged for the long haul,” as stated by Jayasree K. Iyer, the Access to Medicine Foundation executive director. This means that many stakeholders have to join the fight if we are to reach new milestones. Governments, policymakers, and non-profit sector only, will not be enough. Pharmaceutical and medical distribution SME’s (Small and Medium-sized Enterprises), being agile and easier to adapt to a changing business environment, should find opportunity in challenges.

To close the gap in access to medicines in the developing world, a greater diversity of companies must get involved and stay engaged for the long haul

So, going further, private sectors, including generic medicine manufacturers and local distributors, which have become increasingly effective competitors, should increase their efforts as well. By doing so, even small local medical companies can ensure getting a piece of the ‘revenues pie’. As IMS Global Use of Medicines estimates 190 billion in revenues by 2020 and 270 billion in revenues by 2025 could be generated due to the rising need of global generic pharmaceutical products in the developing countries.

There are two main forces that will drive increased pharmaceutical revenues and profits. Firstly, multinational pharmaceutical companies will increasingly focus more on accelerating innovation of drugs for emerging markets. Secondly, since big pharma is losing market exclusivity for many of their older products as their patent protection expires, and are also pledging not to enforce newer patents in poorer countries, patient growth and increasing demand for many generic medicines that now can be manufactured should become the domain of local companies and distributors. Also, generic manufacturers continue to expand the availability of common drugs, such as Amoxicillin, Ceftriaxone, etc., that are still necessary for common illnesses.

Secondary forces are also at work driving revenues and profits, perhaps most relevant to SME pharmaceutical and medical distributors. Even if categorized as ‘emerging’ or ‘developing’, every country has a different set of realities. Different demographics, organization of government, healthcare systems, and even cultural diversity affect the market strategies that need to be implemented in order to thrive successfully. As a small medical distributor, those facts should be important to you, because as a local resident, even if you might not realize, you have a considerable knowledge advantage over the biggest players in the industry by being able to identify niche opportunities in a more timely and cost-effective manner.

The Advantages of a Local

How can a small medical distributor compete with rivals and big pharma?

Even if it might seem complicated at first, there are some simple steps you can follow, in order to catch up with the market and ensure your share in the “revenue pie” the pharmaceutical industry will generate in the next years.

- READ UP: Following specialized media, reporting on trends, news, and problems of the health industry, should be a no-brainer! You must learn about the newest surveys, medical breakthroughs and, most importantly, current diseases, outbreaks and health problems putting your nation at risk. Identify the resources available to you via research, whether it be openly published data from the government, media reports or insider industry information, for the most imminent and first-hand information on specific diseases or medicines that are deficient in the market. Remember that even big organizations, such as WHO, source locally in order to prepare the surveys and reports. For more statistical and analytical information, read articles and newsletters of worldwide specialized media. Here don’t forget about the biggest organizations taking care of global and local health too. Not only WHO, but there are also a lot of other institutions you should know about. By reading one of the United Nations Africa Renewal magazine articles, for example, you could identify that the continent is not only in need of obvious medicines, such as the ones for malaria, tuberculosis or HIV/AIDS but also for diseases like pneumonia, diarrhea, measles, etc. For your convenience, we have already compiled a list of 11 organization that can help you elevate your business to another level, so start by reading AdvaCare's Guide to Global Health.

- BUILT RELATIONSHIPS: Learn from your network. Firstly, visit local events and search the web to learn how SME pharmaceutical and medical distributors are operating - do a SWOT analysis. Also, check which big pharma companies are supplying your country. Secondly, establish personal relationships within both the SME world and also with local big pharma sales representatives in order to get information on the patent releases and expiration dates for the patent medicines needed in your region. Remember, this can be done via LinkedIn as well. In this way, you can have a jumpstart on new generic production and increasingly popular medications. Also look to establish relationships with hospitals, pharmacies, and clinics in order to get updates about which products are in low supply or upcoming trends or changes within the government and private sectors.

- PAY ATTENTION TO INFRASTRUCTURE: Follow the development of new healthcare infrastructure that will inevitably emerge in the market due to increasing demand. Try to establish partnerships with leaders of those new pharmacies, hospitals, clinics, and even NGO programs at the earliest stages.

- COMPARE & RESEARCH: Compare big pharma ranges of offered products with AdvaCare ranges to see which similar generic products you could start offering at a lower price. There is a lot of valuable information you can find just from the websites of big pharma companies, as well as from simple Google searches. In addition, a lot of research and summarization on these same topics have already been done by the Access to Medicine Foundation. Find it here.

- BECOME A REGULATORY EXPERT: Rules, regulations, and IP are another important aspect that you should first be thoroughly acquainted with, aside from the types of medicines and medical devices that are needed in your market. So, make sure you do not only follow your local drug regulatory authority regularly but also keep up with the changes in the registration process. It will help you set up a reasonable timeline for when you decide to launch a new product into the market - accurately assessing the lead time is crucial. In addition to point 2 above, also try establishing relationships with a representative from your local regulatory office. When you manage to do so, make sure you always have open and transparent communication with them.

- HAVE A TARGETED STRATEGY: Form different distribution strategies, meaning product selections, warehousing, marketing, etc., according to the region — at least one should be separating urban areas from rural. Rural areas can have different diseases to be treated and more injuries related to physical work. On the contrary, more bacterial and virus infections could emerge in urban areas due to population density. Different regions might require different strategies. Besides location, living conditions and common health issues for the preparation of targeted strategy, you might also consider the differences in the access to healthcare, income, and rates of communicable diseases. Consider this... some distributors have an expansion strategy that firsts targets rural areas, then moves into the cities. While this might not be efficient in many markets, it is still an effective strategy when deployed in the right conditions, especially if there is an unfulfilled demand in rural areas that can provide growing cash flow for the distributor to make a strong expansion into the cities.

- FIND YOUR NICHE: While talking to all of your stakeholders, like potential patients, your partners in the distribution chain, medical professionals, authority figures, and so on, try to find your niche. Maybe there is a demand for a product that doesn’t even exist yet, or maybe a product does exist but there is still room in the market for another brand. Also, it is common knowledge that brands are easier to build in emerging markets, therefore allowing more niche opportunities to exist. AdvaLife Nutraceuticals, a brand of AdvaCare Pharma USA, is one such example of creating a niche in a crowded industry. AdvaLife consists of a wide range of quality dietary supplements, but many competitors exist. AdvaCare has created a competitive advantage, which has facilitated the rapid expansion of the AdvaLife brand, by providing a product of US quality standards at low price points for developing markets. See more about AdvaLife and our competitive advantages here. You shouldn’t forget to also think about lifestyle health-related trends. Even supplements and home-used medical devices are becoming popular in many developing markets as disposable income increases for the growing middle classes.

As a local medical distributor, make sure you identify the correct opportunities and, if possible, find your niche

In conclusion, don’t be afraid to look at your SME rivals and big pharma as your competition. As you can see from the list, they can be a great source of information and inspiration. Look for niches and opportunities, but even more importantly, focus on the preparation, implementation, and execution of a structured plan. And remember, only with all stakeholders working side-by-side, can unnecessary deaths in the developing world be reduced, and your country can improve the standard of healthcare for everyone.

Companies like AdvaCare, are able to supply the locals with generic drugs at affordable prices, flexible options for local consumer adaptations, and marketing support. Learn more about becoming our distributor.

aaa

Don't want to miss the next AdvaCare article?

Recommended Content

Pet Supplements Manufacturer: Functional and Premium Ingredients with USA Quality Standards & Traceability

Global Pet Supplement Market Trends: Why Distributors are Shifting to Premium Grade Quality

TickZero™: High-Margin, 12-Week Flea & Tick Protection, Distributor Opportunity in LMICs