Pet Supplements Market Set to Exceed $1b by 2027. Are you Ready?

Contents Overview

Just like human supplements, there are more and more options available for pets. Becoming increasingly more concerned about the health and well-being of their pets, owners around the globe are spending big on supplements and nutrition. Consumers, in developed and developing markets alike, are appropriating a larger proportion of income to maintaining health, preventing diseases and prolonging the lifespan of man's best friend.

Dietary Supplements for pets, also referred to as "pet nutraceuticals", provide essential nutrients that help to fill nutritional gaps resulting in a stimulated immune system, reduction in the risk of diseases, better overall health and ultimately a prolonged lifespan. Most commonly given to dogs, cats, horses, birds, reptiles, and other small animals and fishes, market leading pet supplement product categories include multivitamins, minerals, prebiotics, antioxidants and fatty acids such as Omega 3,6,9. Herbal extracts are also growing market share as further product differentiation gains traction. At AdvaCare Pharma USA, we’re constantly expanding our pet supplement product range to meet demand from our markets and to provide our distributors with specialized products needed to gain market share, including:

- Bladder & Urinary Support

- Skin & Coat Support

- Blood Support

- Liver Support

- Vision Support

- Heart Support

- Probiotics Digestive Support

The Pet Industry Boom

The pet supplement sector has been experiencing explosive growth. Mintel’s research on pet industry trends up to 2019 shows that pet owners are committed and open to spending money on the latest trends in pet supplements. Many pet owners want their pets to be as healthy as they are. This new decade will also see a continuing rise in the number of pet nutritional products containing additives such as basic vitamins and omega-3 fatty acids, further fueling the growth of the supplement industry.

"The rise of pet supplements invites innovation in product development further pushing the boundaries of what owners are willing to give their pets".

In fact, consumers increasingly don’t even want traditional pet supplements any longer, but instead are opting for healthy ingredients that can be verified - the ingredients listed on the label are dictating sales figures. Therefore, product awareness amongst distributors is now crucial. Retailers and consumers prefer color-coded, resealable packaging and more product information to enable informed decisions for a better end customer experience. Detailed ingredient information including the source of raw materials, indication of product usage, possible interactions and adverse effects and pet owner tips give distributors a competitive advantage over other brands. AdvaCare includes QR codes on all of our product packaging to provide valuable product information, allowing for a better customer experience with AdvaCare brands and ultimately brand loyalty and better customer retention. These QR codes link directly to the company's page to provide detailed product information and also serves to make clear to consumers that no harmful chemicals or toxic solvents are contained in our products.

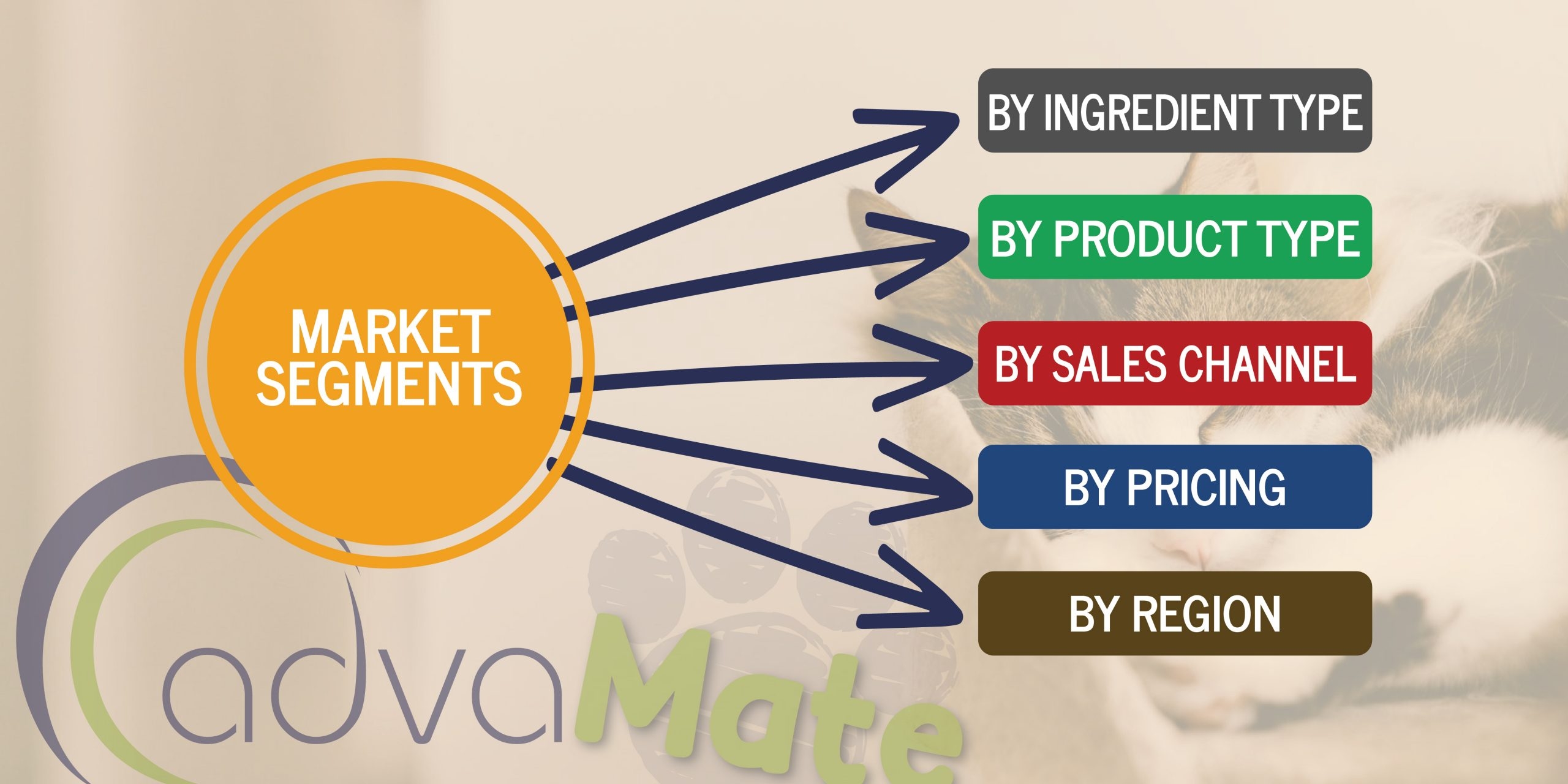

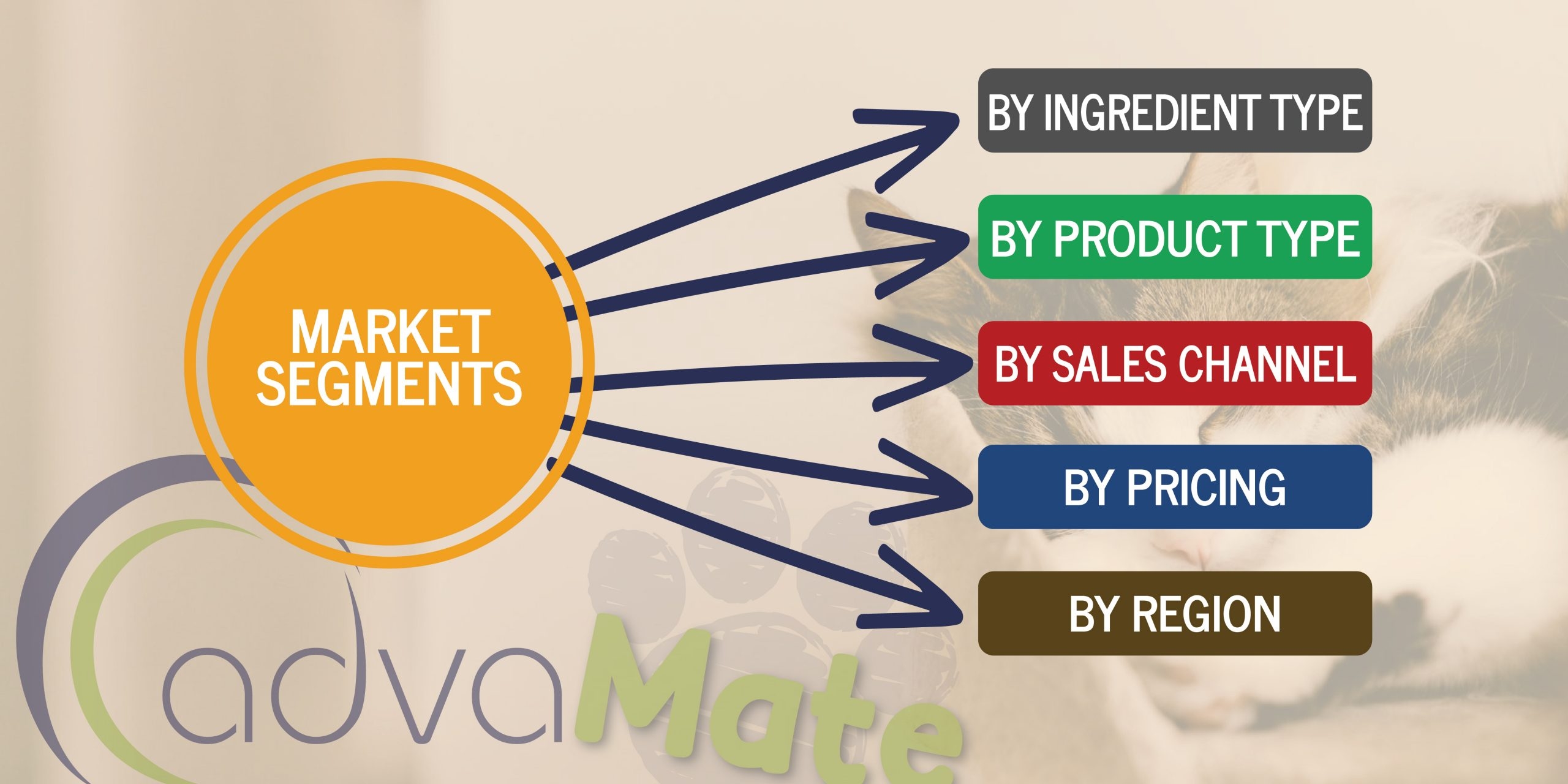

Supplement Industry Breakdown

Ingredient Type

- Singular Ingredient vs. Formulation

- Animal-derived vs. Plant-derived

- Vitamin/Mineral-based

- Herbal/Natural-based

- OTC/Treatment

Product Type

- Dog

- Cat

- Horse

- Bird, Reptile, Fish

- Other small animals

Sales Channel

- Offline

- Online

Pricing

- Mass Products:

- Low price point

- Largest market share

- Standardized products

- Niche Products:

- Medium price point

- Smallest market share

- Specialized products

- Premium Products:

- High price point

- Small but growing market share

- Customized products or premium ingredients

Region

- USA:

- #1 global market share

- Strong, low-medium growth

- EMEA:

- #2 global market share

- Early, very high growth

- APAC:

- #3 global market share

- Early, very high growth

- LATAM:

- #4 global market share

- Early, high growth

- MENA:

- #5 global market share

- Early, high growth

- AU:

- #6 global market share

- Early, high growth

Other demographics include

- Product-specific: Glucosamine, Omega 3 Fatty Acids, Probiotics & Prebiotics, Multivitamins, Antioxidants, Proteins & Peptides, and Others

- Ingredient-specific: Fish, Meat, & Animal Derivatives, Dairy Products & Eggs, Vegetables, Cereals & Cereal By-Products, and Others

- Form-specific: Tablets & Capsules Derivatives, Soft Gels & Gummies, Liquids, Powders, and Others;

- Application-specific: Skin & Coat, Joint Health, Liver, Gastrointestinal Tract, Kidney Support, Balanced Diet, and Others.

Distribution Channels

A mix of distribution channels exist. Retail stores and online stores are both improving customer engagement through omnichannel retailing as they are also selling products through the medium of e-commerce portals, which has proved a major increase in sales over recent years. The numbers will rapidly increase as soon as retailers adapt online sales channels to a post-Coronavirus marketing model.

- Offline Distribution accounted for the largest share of more than 90% in 2019 due to easy availability of supplements in supermarkets, hypermarkets, medical stores, pet shops and convenience stores.

- Online Distribution of pet supplements, while still small compared to offline sales, is projected to exhibit the higher CAGR of 9.7% during the forecast period due to increasing penetration of smart devices. A growing range of fresh supplements and increasing customer loyalty through subscription and discount programs are expected to drive the online channel segment.

Why do Emerging countries Follow this Trend?

The increasing urbanization, growing trend of nuclear families, changing perception towards animals and increased pet adoption rates are the main trend factors in emerging countries.

Some of the changes in pet ownership are due to technology and the advent of online purchasing. But most of the growth is because of changes in culture. As Millennial and Generation Z consumers have come into adulthood, they have embraced the pet-owning and pet-loving lifestyles to a far greater extent than their elders. Millennials and Gen Xers are clearly adopting more pets than older generations. As we know, Millennials with pets also tend to use technology to purchase products and services. This has helped form a powerful market with a presence of new ventures in pet-related business. With this in mind, the pet market should continue to expand in size. The most demand in pet supplements category is visible in APAC region, estimated with total 7.9% growth over the forecast in 2019. For instance, in India, dogs are more popular than cats, birds, and horses. Dog supplements will account for a significant market share in the forthcoming years.

Benefits for Distributors

Why is it Worth Investment?

Over the years, pet owners have dramatically changed the way they think about and care for their pets. The rising demand towards animal welfare will lead the pet supplement industry to surpass $1 billion USD in revenues by 2027, making it a major global industry. The pet healthcare industry combines veterinary pharmaceuticals, diagnostics, product distributors and services, manufacturers of pet food and pet supplies, and online and traditional pet and pet supply stores. Each of these sub-industries is responding to the demands of pet owners with continued innovation that’s led to massive growth.

At AdvaCare Pharma USA, we have dedicated R&D and focused heavily on the product development of pet supplements by drawing on the vast knowledge of our global presence in both the veterinary and human supplement sectors. Producing over 150 livestock veterinary medicines and over 130 human supplement products, we have leveraged our unique capabilities to formulate a range of quality, specialized, affordable pet supplement products which ensure our distributor's customer demands are met and profitability is achieved. Introduction to new processing technologies along with automated systems for the production of our finished products is anticipated to drive the growth in the forthcoming years. We are constantly focused on meeting the demands of our distributors and guiding their success… see what makes AdvaCare a different kind of pharmaceutical company.

Don't want to miss the next AdvaCare article?

Recommended Content

How to Profit From the Booming Market of Disease Prevention?

Supplements and Chronic Disease Prevention: The Next Big Thing in Pharma? A 3-Step Guide for Supplements Distributors

Trillion-Dollar Reason Why You Should Supply Supplements to Emerging Markets